| |

|

The Invoice Entry window is used to create and manage invoices. You

may create an invoice with one or more lines, and with different income

accounts and VAT rates on each line, if you wish.

The first step in creating an invoice is to enter a date, an ID Number

and a Summary of the entry. It is important to put something into

the ID Number and Summary boxes, as these are the details which

appear in various lists in the program, and these are what you will

use when searching for entries.

Each invoice may have two addresses on it - an invoice address and a

delivery address. The program will bring up a new window to allow

you to select an address, when you click on the arrow above the box.

You may also type directly into the two address boxes.

After you have filled in these details, you are ready to fill in

the invoice lines.

Adding

A Line

To add a line to the entry, simply click the Add Line button.

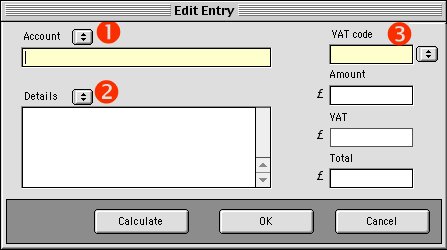

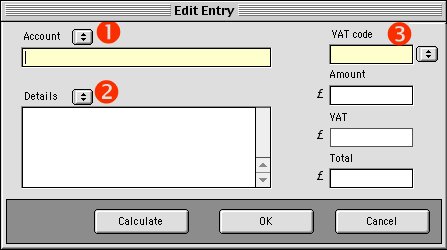

The window below will now appear.

(1)

The first item to choose is the account you wish this line to be

allocated to. Clicking on the drop down arrow, brings up a list of

accounts from which to select.

(2)

You may now enter the details of this line. If you wish to use a

phrase which you have stored in the Standard Phrases window,

click the drop down arrow to bring up the list of stored phrases.

(3)

If you are tracking VAT, and you wish to use a VAT code on this

line, click on the drop down arrow beside the VAT box and choose a

code from the list which appears. You can then enter either the Amount

or the Total for the line, and click on the Calculate VAT

button to prompt the program to fill in the other amounts. It is

important to remember that although the program calculates what it

thinks the VAT amount should be, you are responsible for ensuring

this amount is correct. For example, in the case of spending money,

no matter what the program calculates the VAT amount to be, you have

to enter whatever you have been charged by your supplier.

Once you have finished entering the line, click the OK button

to return to the entry window, or click Cancel to reject the

line.

Editing

A Line

To edit a line, click on the line in the list, then press the Edit

Line button. The details of the line will appear using the same

window for new lines, as shown above.

Deleting

A Line

To delete a line, click on the line in the list, and then press the Delete

Line button.

As you add, delete or edit lines of the entry, the program

calculates the Subtotal, VAT Total and Total

amounts for the entry.

At the bottom of the window, you will see a comments box. These

comments appear at the bottom of a printed invoice. You may type the

comments into the box, or click the arrow above the box to choose

from the list of standard comments phrases.

Invoice

Status

The last thing that needs to be done to the invoice, is to choose

its status. There are four status options from which to choose...

Estimate: An estimate is an invoice which has been created,

but not sent to any customer for payment. It has no effect on any

cashbook accounts, and is not treated as outstanding.

Quote: A quote is an invoice which has been created, and then

sent to a customer for payment. The payment is outstanding, and the

number of days since the date on the invoice will appear on the

debtors list report, and will be shown in this Invoice List

screen.

Posted: A posted invoice is one which has been created; and

then sent to, and finally paid by, the customer. In terms of the

program, it means that a new entry was made in the Receive Money

window to account for the customer's payment.

Rejected: A rejected invoice is one where, for whatever

reason, the invoice was never posted to the cashbook accounts.

If you choose to select Posted, and close the invoice, a copy

of the invoice will be turned into a cashbook Receive Money

entry, and will appear in the Receive Money window. From

there, you are free to post it to the cashbook as you would with any

other Receive Money entry.

A last note on the status. Different businesses use different terms

for an invoice, a quote, a credit, etc., so CashBook 200 does

not use its own status terms (estimate, quote, posted and

rejected). Instead, it provides the Title box (just below the

status drop down list). In this box, you should type whatever you

want to appear at the top of the printed invoice - it can be

whatever you wish.

When you have finished with the invoice, click the Close button

to return to the Invoice List window.

|

|

|